States Attracting Most Foreign Taxpayers in 2013 are Texas, Virginia, and Colorado; California, New York, Illinois Lose Most

Recently released data from the Internal Revenue Service shows that foreign taxpayer net migration (total in-migrants minus out-migrants) is the highest for Texas, which gained 1,700 households in 2013 from foreign locations. Virginia attracted 1,200 net new foreign households, followed by Colorado (400).

“Households” is a proxy for the IRS-reported number of tax returns. Foreign taxpayers include military households, foreign nationals from US Territories, and US Citizens abroad. Analysis of US-wide data shows that military households relocating from APO/FPO addresses account for 45% of migration, Puerto Rico and the Virgin Islands account for 6%, and other foreign locations account for the remaining 49%. Percentages will vary by state.

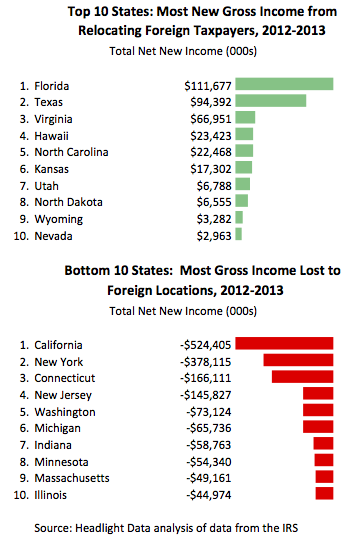

Florida gained the most net new Gross Income from foreign relocations ($112 million), followed by Texas ($94 million), and Virginia ($67 million). California lost the most Gross Income (-$524 million), followed by New York (-$378 million), and Connecticut (-$166 million).

Click here to download a spreadsheet of the complete data.

This map shows total net migration into individual US states from Foreign Taxpayers from 2012-2013 based on IRS tax return data. Migration can be measured in terms of total returns, total exemptions, and total gross income. Net Migration is measured as the difference between in-migration into the state and out-migration from the state.

Select a metric to see net migration flows for that state. Float your cursor over a state to see the actual value. If you don't see a map below, Click here to see it in Tableau Public.

Permission is granted to embed this map in any website. Click the "Share" button to get the embed code.